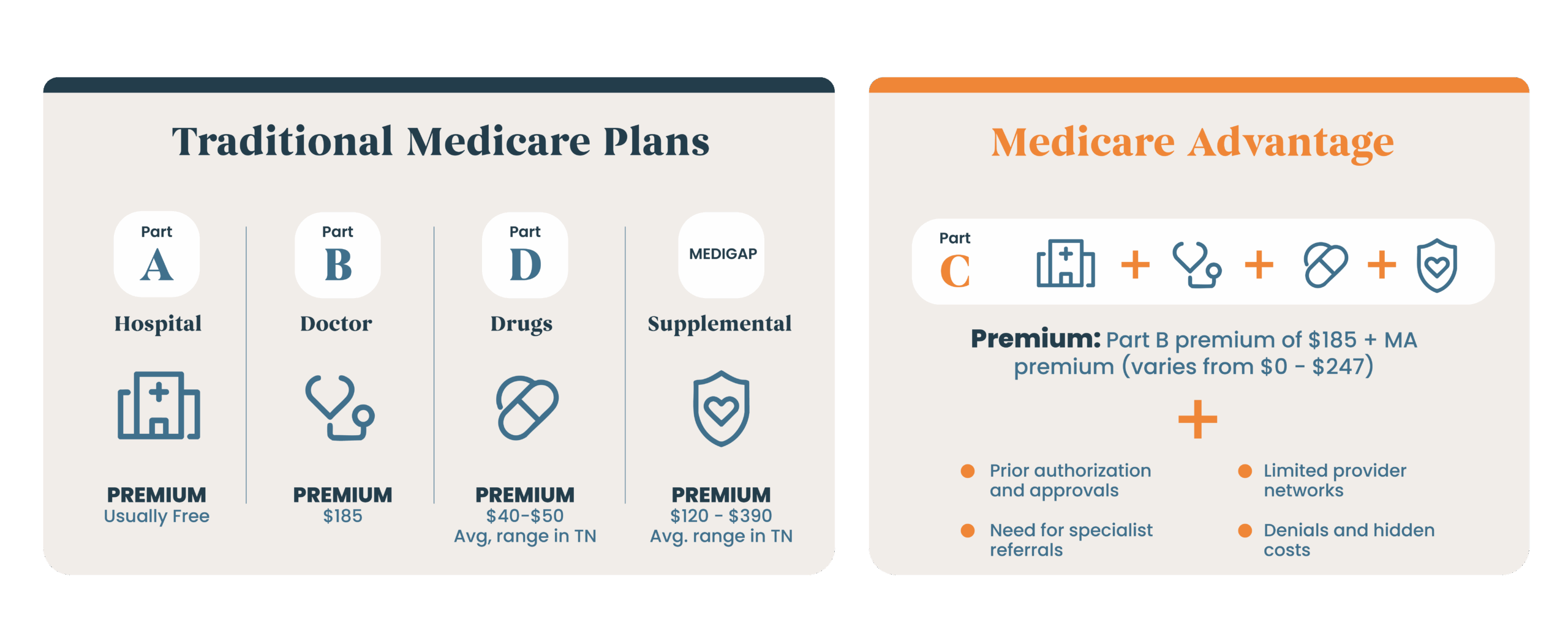

Traditional Medicare Plans in Detail

Traditional — Part A

- Covers hospital care

- Covers 80% of the cost for most medical bills

- Can use any hospital that takes Medicare, anywhere in the U.S

- Can add on additional coverage o help with unexpected costs

- Can add drug coverage

Premium: Usually Free

Traditional — Part B

- Covers doctor’s care

- Covers 80% of the cost for most medical bills

- Can use any doctor that takes Medicare, anywhere in the U.S

- Can add on additional coverage o help with unexpected costs

- Can add drug coverage

Premium: $185

Traditional — Part D

- Optional plan that adds drug coverage to Traditional Medicare

Premium: Average range in TN is $40-50

Traditional — MediGap

- Supplemental optional plan that helps pay your out-of-pocket costs that Part A and B don’t cover – like your 20% coinsurance

Your benefits won’t change, and as long as you pay premiums you keep your coverage

Premium: Average range in TN is $120 – $390

Medicare Advantage in Detail

Medicare Advantage — Part C

- Bundles hospital care, doctor’s office care, supplemental coverage and drug coverage into one plan

- Benefits are provided by a commercial insurance company

- You are restricted to using only the doctors and hospitals in your plan’s network

- You may need to get approval (prior authorization) from your plan before it covers certain types of care

- Plans may offer some extra benefits that Traditional Medicare doesn’t

- May not cover your care if you are away from your hometown area

Premium: Part B premium of $185 + MA premium (varies from $0 – $247)

Medicare Advantage Hidden Costs

- Out-of-Network Charges

If you see a doctor or go to a hospital outside your plan’s network (except in emergencies), you may pay much more—or even the full cost—for care.

- Prior Authorization Delays or Denials

Prior authorizations can lead to delays in care or denied coverage, shifting unexpected costs back to you.

- Higher Out-of-Pocket Costs for Complex Care

Medicare Advantage plans often have copays and coinsurance for each service which can add up quickly if you have an illness, injury, or chronic condition.

- Missed Medigap Opportunity

If you later switch from Medicare Advantage to Traditional Medicare, you may not be able to buy a Medigap plan—or it could cost more—due to medical underwriting.

- Limited Access to Specialized Care

Some top specialists, hospitals, or academic medical centers may not accept Medicare Advantage plans, meaning you’d pay full price for out-of-network care or be forced to switch doctors.

- Annual Changes to Coverage

Benefits, provider networks, and out-of-pocket costs can change every year, requiring you to carefully review your plan annually to avoid surprises.

Medicare Advantage plans may seem like a simpler, lower-cost alternative to Traditional Medicare. However, simplicity and lower monthly premiums typically come with tradeoffs:

- Tedious prior authorization processes

- Need for specialist referrals

- Limited provider networks

- Higher overall costs due to care denials and hidden costs.

The Bottom Line

Traditional Medicare + Medigap is best if you:

- Want more predictable healthcare costs.

- Prefer the freedom to get care from the doctors and hospitals you want.

- Prefer to pay more in monthly premiums in order to avoid commercial health insurance red tape that can cause care delays and denials.

Medicare Advantage is best if you:

- Want to save on monthly premiums and are prepared to pay more out-of-pocket if serious health issues arise.

- Prefer to have all of your healthcare coverage bundled into one plan and want “bonus” benefits like a gym membership or wellness program.

- Are comfortable with limited provider networks and the need for prior approvals and referrals for most services.