Patient: Rose, 68 years old

Issue: Rose has had persistent lower back pain radiating down her leg for 3 months

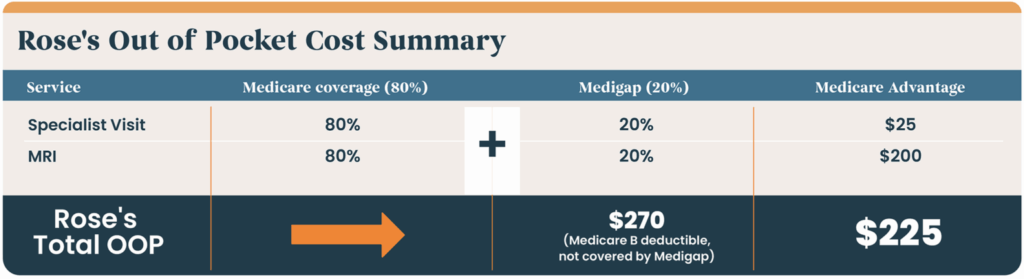

Coverage: Medicare (A, B) and Medigap

Rose has an office visit with her PCP who, upon inspection, refers her to a specialist. The specialist, an orthopedic doctor, evaluates Rose and determines that an MRI is necessary.

Because Rose has Medicare, the specialist can schedule the MRI immediately without prior authorization delays.

With Rose’s Medicare part B coverage, 80% of outpatient services like MRIs are covered. Rose’s Medigap coverage will then step in and pay the remaining 20%

Coverage: Medicare Advantage with a $25 specialist copay and $200 MRI copay

Rose has an office visit with her PCP who, upon inspection, refers her to a specialist. Because Rose has an Advantage plan, she must get a referral to see the specialist. The specialist, an orthopedic doctor, evaluates Rose and determines that an MRI is necessary. With Medicare Advantage plans, prior authorizations are required for most MRIs. The prior auth approval times vary but typically take 2-5 business days. Rose will not be scheduled for the MRI until the authorization approval is returned and confirmed.

With Rose’s Medicare Advantage coverage, she will pay $200 for the MRI copay and a $25 specialist copay for her visit with an orthopedic provider.

Patient: Blanche, 73 years old

Issue: Osteoarthritis in right hip, causing limited mobility and chronic pain

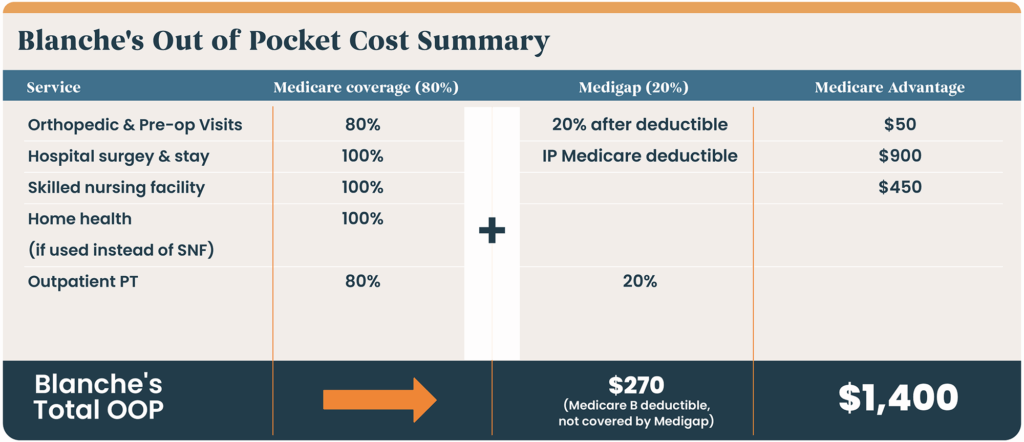

Coverage: Medicare (A, B) and Medigap

Blanche has been experiencing worsening hip pain, so she visits her PCP, who refers her to an orthopedic specialist. It is confirmed that Blanche will need a total hip replacement. Because Blanche has Medicare, no prior authorization is required for inpatient surgeries. All pre-op labs and tests are all covered under her part B coverage. Medicare covers her inpatient hospital stay while her Medigap coverage picks up her inpatient Medicare deductible.

After surgery, Blanche is discharged to a Skilled Nursing Facility for rehab. Medicare covers 100% of her rehab stay. Because Blanche has Traditional Medicare & Medigap, no prior authorization is needed. Medicare covers surgery, inpatient stay, and rehab in either a skilled nursing facility or through home health.

Coverage: Medicare Advantage; $300 day hospital copay, $50 specialist copay, $250 outpatient surgery copay, $150/day SNF copay.

Blanche has been experiencing worsening hip pain, so she visits her PCP, who refers her to an orthopedic specialist. It is confirmed that Blanche will need a total hip replacement. Because Blanche has Medicare Advantage, prior authorization is required for inpatient surgeries, hospital stays, SNF, home health and DME.

Patient: Ross, 66 years old

Issue: Ross was recently diagnosed with Stage II prostate cancer

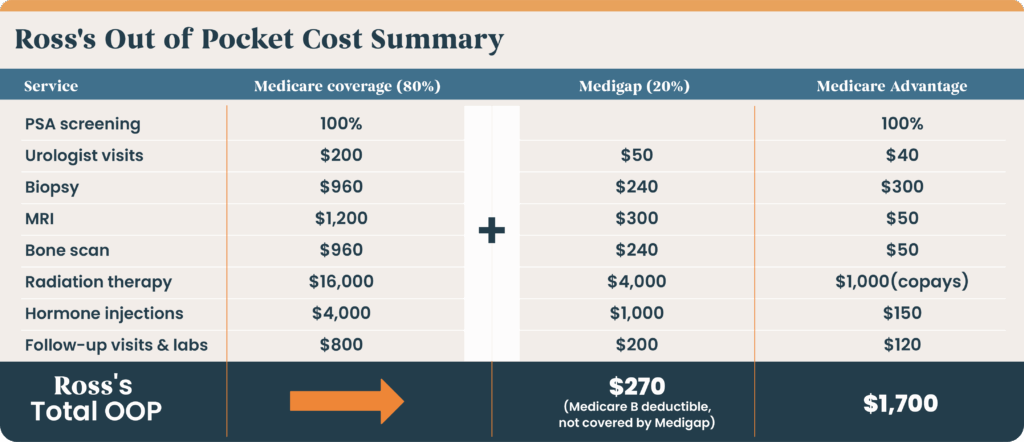

Coverage: Medicare (A, B) and Medigap

Ross was diagnosed with Stage II prostate cancer after a routine PSA test. He will require urology visits, imaging, biopsy, radiation, and hormone therapy.

Because Ross has Medicare and a supplemental Medigap plan, he only pays the part B deductible. His Medigap supplemental policy covers all other expenses that Medicare doesn’t—this setup provides nearly complete financial protection for a serious condition like cancer.

Coverage: Medicare Advantage

Ross was diagnosed with Stage II prostate cancer after a routine PSA test. He will require urology visits, imaging, biopsy, radiation, and hormone therapy.

Because Ross has a Medicare Advantage plan, many of the services he needs will require prior authorization, possibly delay treatment, and increase his out-of-pocket costs.

Patient: Paolo, 75 years old

Issue: Stroke

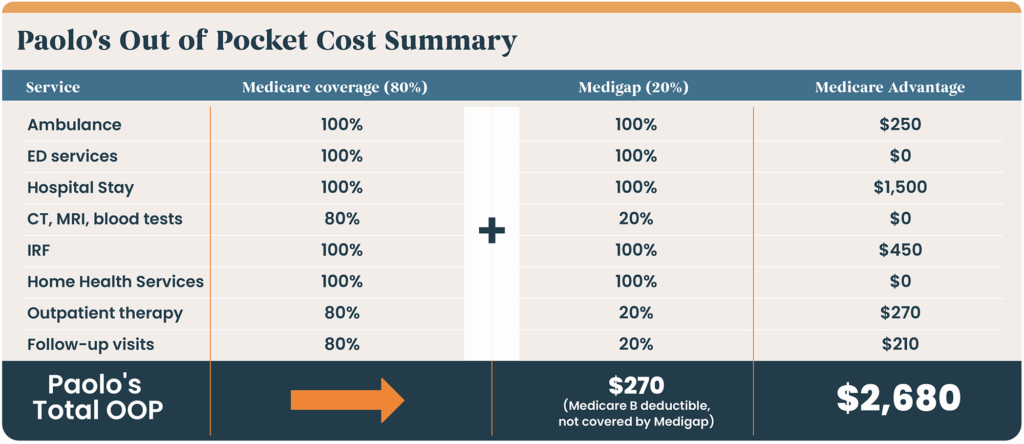

Coverage: Medicare (A, B) and Medigap

Treatment: Emergency hospitalization, inpatient rehab, outpatient therapy

Paolo experiences sudden weakness and slurred speech. 911 is called, and Paolo is taken to the nearest hospital. A CT confirms a stroke. He is admitted for 5 days of inpatient care, after ED services are completed. After his acute stay, Paolo is transferred to an Inpatient Rehab Facility. He is discharged home with home health services that include 2-3 visits per week for therapies. Paolo must continue outpatient physical therapy and follow-ups for the next 30-60 days to conclude his continuum of care.

Coverage: Medicare Advantage

Treatment: Emergency hospitalization, inpatient rehab, outpatient therapy

Paolo experiences sudden weakness and slurred speech. 911 is called and Paolo is taken to the nearest hospital. A CT confirms a stroke. He is admitted for 5 days of inpatient care, after ED services are completed. The hospital must be in-network with Paolo’s Medicare Advantage plan in order to receive full coverage. As he is nearing discharge from his acute stay, prior authorization is requested by the hospital. Paolo remains in the hospital while the authorization is being reviewed—once approved, Paolo is transferred to an Inpatient Rehab Facility. He is discharged home with home health services, and once, auth is approved, will receive therapies 2-3 visits per week. Paolo must continue outpatient physical therapy and follow-ups for the next 30-60 days to conclude his continuum of care.

Disclaimer: The scenarios provided are for illustrative purposes only and are not based on real individuals. They are intended to reflect common experiences under Medicare and Medicare Advantage plans. Actual coverage details, costs, and requirements may vary based on the specific Medicare Advantage plan. For personalized information, please consult your plan provider or visit Medicare.gov.

Sources: